![]()

We have had EcoCash for what seems like an eternity now. As it has matured we have come to expect less and less in the way of innovations. That’s exactly what we expect to see when it comes to services and products we have been using for over a decade.

We are so used to how EcoCash works we don’t want to wake up to ‘innovations’ that may change the status quo. There comes a time when control over a product/service’s future is wrestled from the creator and transferred to the users. That happened a while ago in mobile money, and for EcoCash especially.

As a result, the only innovations we crave are reliability improvements. Improve up-time and we are happy campers.

That said, I am reminded of Henry Ford saying if he had asked people what they wanted, they would have asked for faster horses. The automobile would never have been. This to say we don’t think we need innovations until they arrive and we can’t imagine how we used to live without them.

How we use EcoCash

We know how to use EcoCash. It’s either we’re fiddling with USSD menus (*151#) that require our complete attention and the speed of a professional gamer. Get distracted for a second and you’re timed out and forced to start over.

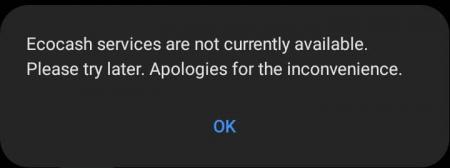

If that’s not your cup of maheu, you can always use the EcoCash or Sasai apps. For some reason, they don’t quite work for me reliably and so USSD has been my go to.

If we have any challenges with the service we know what to do. There are toll free numbers we can call, social media pages we can harass and WhatsApp customer service numbers we can use. However, with us being in the millions the reality is that we often have to wait a little bit to be served.

What if chatbots came into the picture though? And what if that chatbot was on our favoured WhatsApp?

EcoCash Assistant

EcoCash has been readying a WhatsApp chatbot and you may have even helped pick out a character from the 2 that were on offer. Apparently ya’ll went with Thembie and that is the new EcoCash Smart Assistant.

To use the new assistant all you need is to have access to WhatsApp, which you have more often than not. The data is clear, WhatsApp is the internet in Zimbabwe and taking EcoCash to WhatsApp should be thought of as EcoCash finally being available on the internet.

Say Hi to Thembie, your EcoCash Smart Assistant on WhatsApp/Telegram 0777222150, to get assistance on all your EcoCash issues from the comfort of your home.

EcoCash

Simply save that number and then start a chat in WhatsApp.

Here’s what you’re able to do with Thembie:

Merchant Payment.

Bill Payment.

Airtime Purchase – Bundles and USD airtime will be added soon.

Send Money.

Send Money Reversal.

ZESA Token Purchase.

Banking Services.

PIN RESET.

Statement Request.

Balance Enquiry.

That’s quite the list and I’d imagine for many of us, once bundles and USD airtime are added, we won’t want for anything else. Do note, if Telegram is more your thing you’ll get the same experience there. However, it appears that will happen later, right now Telegram says Thembie is not on the platform yet.

Some of what you cannot do includes Cash Out, Debit Card, Kashagi and Savings Club and Ecocash diaspora stuff. I can live with that.

Thembie is easy to use

Props to EcoCash for the good implementation. Using the new assistant should be straightforward for everyone who has used WhatsApp before.

Thembie first verifies your identity and that involves sending a verification code via SMS to your EcoCash number. You then have to input your EcoCash PIN and you’ll be glad to know that you won’t actually type in the PIN in the chat. Rather you get a popup prompt like the one you get in a supermarket.

Then come the security questions. You know how it goes, you tell Thembie your favourite cousin, sport etc to be used to verify you’re you when you forget your PIN later. These you have to type in so I’d suggest deleting the answers after you’re done.

After that you’re free to do whatever you want. You just tell Thembie what you want to do by typing in any of the keywords above e.g. Send Money or Banking Services and it all happens via WhatsApp, the PIN prompt being the only USSD input you will deal with.

I purposefully mistyped some words and for the most part, Thembie knew what I was talking about. Even shorthand like ‘snd’ for send works. You don’t have to type in Bill Payment like a chump, just say ‘bill’ and you’ll be good to go.

In all this you don’t have to worry about timing out. You can take your sweet time responding and Thembie won’t force you to start over like her temperamental brother, USSD.

What do you think?

I don’t think I’m ever going to faff around with USSD menus again, of course WhatsApp bundle permitting. Seeing as we’re all almost always on WhatsApp, I think this is the best way to transact on EcoCash if the app doesn’t work for you.

However neat I think the transaction functionality is, it is secondary. After all, there are many ways to kill that cat. Thembie really is about customer service.

Customer service

As regards customer service, normally, chatbots are not my thing. I’m a pro-Googler and by the time I need help from customer service, it’s usually a tricky little issue that chatbots cannot help with. That said, making a typo and sending money to the wrong person can happen to anyone.

Talk to customer support teams and they will tell you that they get questions about the most basic of problems more than anything else. We all make silly little makes from time to time.

Problem is, in many cases we don’t bother trying to resolve the issue ourselves. We call the customer support team even when, for example, we could have done a PIN reset ourselves in a few seconds.

In fact, EcoCash says PIN resets, send money reversals and statement requests account for more than 90% of customer support queries.

For some reason we prefer calling customer care about PIN resets and statement requests when it would be quicker to do that ourselves. Maybe USSD with its timeouts is too much of a hassle and that’s why we don’t use it to resolve those issues.

So, we all turn to customer support, in our millions, and the experience becomes terrible for all involved. The common cry in Zimbabwe is that customer service sucks. It does. We clog the lines with the same issues.

Self service

Thembie is actually meant to ease this load, allowing customers to resolve their issues themselves, with her help of course. WhatsApp could be just what the doctor ordered.

So, if the chatbot helps people with that, that will free up the customer service personnel to deal with the more challenging issues. We all win. We have all complained about terrible customer service and if Thembie eases the load on the overwhelmed support team I’d be ecstatic.

Try out the EcoCash chatbot yourself and see what’s what.

Related:

Innovative clinic uses WhatsApp chatbot to serve and screen patients

EcoCash Distances Self From Fake Customer Service Number

Hotbox the WhatsApp chatbot that replaced Duta is now at 300K users

Nyaradzo’s chatbot Sahwi is now available on WhatsApp

Quick NetOne, Econet, And Telecel Airtime Recharge

The post New EcoCash Assistant on WhatsApp allows you to transact and resolve common issues, simple but could be great appeared first on Techzim.