![]()

Yesterday, EcoCash celebrated its 10th anniversary. Only 10? It feels like we’ve had the mobile money solution for longer than that. That’s because of just how much impact the service has had in our lives.

Granted, the last few years have been tough for the mobile money services provider. But there is no denying we cannot talk about the payment industry in Zimbabwe without talking about the service.

As we celebrate with Cassava and Econet, let us look back on a very eventful first decade in business for EcoCash.

2011: Launch of EcoCash

I was a broke young adult then when I heard about EcoCash. I had no idea what mobile money meant but they were promising a dollar for every signee, so obviously I was in.

I wasn’t alone, many signed up for the free dollar. As we understood the service better, even more signed up. So quick was the uptake that in only 14 months, EcoCash had reached 2 million subscribers.

The mobile money puzzle needed three main pieces – subscribers, agents and merchants.

Therefore, agents and merchants were also incentivized to sign up. Econet paid out 80% of revenue in agent commissions and agents signed up in droves. With that move, domestic remittance was conquered.

Merchants were promised no service charges and with nothing to lose, they signed up. With that, EcoCash users were able to pay for almost everything they needed using the mobile money service.

Strategic brilliance was observed with the acquisition of TN Bank just six months after launch.

Realising that they needed to partner a deposit-holding bank and yet their service would be competition to the same bank, an acquisition was planned. That would safeguard against bank retaliation to EcoCash success and my goodness, was that prophetic.

All in all, that was quite the launch. 10/10. Flawless. Users loved the service, agents and merchants were happy and the regulators were on board with it all.

2013-2018: The growth, maturity and dominance of EcoCash

The plan was to scale quickly and that, they did. They continued improving the service and introducing new features faster than the competition could.

- Bill payments were introduced, from DStv to electricity. This being Zimbabwe, it took a little fight to get ZETDC payments on EcoCash. Initially, the parastatal exclusively accepted payments using fellow parastatal NetOne’s mobile money solution. EcoCash users were not amused and they pressured ZETDC into accepting EcoCash.

- Payroll and bulk payments were introduced to make EcoCash usable as a business solution.

- Zinara e-toll payments were introduced for motorists.

- Duties and taxes – this was the moment. When citizens can pay their taxes and duties using a currency or platform, at that moment the currency or platform becomes officially accepted. EcoCash was a bonafide payment method at this point.

At that point, one could pay for almost any product or service in Zimbabwe using EcoCash. That was in addition to being able to send even micro amounts of money to almost anyone, anywhere in the country.

International aspirations

Diasporans were not forgotten, the millions of Zimbabweans living outside the country. For them International Remittances were introduced. An example being the EcoCash Home Wallet for Zimbos in the UK. This allowed them to pay for services in Zimbabwe for family.

For locally based Zimbos, a partnership with Mastercard brought the global market to their doorstep. A virtual prefunded debit card allowed purchasing from anywhere Mastercard is accepted.

Retention

With dominance established, attention moved to retention and monetisation of the huge subscriber base. Several features were introduced to make the service even more popular.

- EcoCash loans – were wildly popular and saw 500,000 new account openings in just 2 weeks. In the process, Steward bank (TN) became the largest bank by number of accounts.

- EcoCash Save and Savings Clubs – essentially made EcoCash a savings account. One with no monthly service fees at that.

- Swipe into EcoCash – some banks were still resisting integration with EcoCash so this was the solution for users to be able to get their money out of their bank accounts and into EcoCash.

All these moves cemented EcoCash’s dominant position in the mobile money industry. The next step naturally was to unshackle EcoCash from Econet.

EcoCash beyond Econet

The Econet Global group was restructured and a new Cassava Fintech was introduced. EcoCash would fall under this parent, which would be listed separately on the Zimbabwe Stock Exchange.

Having integrated with all commercial banks around this time, the last hurdle was other mobile network operators (MNOs) – NetOne and Telecel.

Swiftly, the doors were opened. Subscribers to the rival MNOs were welcomed into the fold. EcoCash had essentially become a bank.

All one needed to open this bank account was an ID, proof of residence and a phone number, any phone number.

Cash crisis in the country

As if EcoCash needed help in it’s rapid ascension, a cash crisis broke out in the country which improved the service’s fortunes exponentially. Zimbabweans had no choice but to use electronic methods for payment, hard cash was simply not available.

Banks could have capitalized on this but the KYC requirements for commercial banks remains stricter than for mobile money operators.

Therefore, mobile money services benefitted most from citizens having to exclusively use electronic forms of payment.

In 2017-18, they consistently had:

• Over 80% of ALL financial transactions by volume

• Over 95% of all mobile money transactions

• Over 95% of mobile money subscribers

• Over 90% of mobile money agents

These are monopoly level figures and the government started to worry a bit. After all, EcoCash was not a government run platform and yet it had that much power.

Government intervention

In hindsight, they should not have allowed their dominant position to get that far. That was the beginning of their regulatory troubles.

Then ICT minister was on record saying EcoCash’s dominance could be disastrous if not curtailed. So, curtailing had to commence.

It may be a commercial success but it’s a disaster if we look at it from a public sector point of view. What happens if that system fails at a critical moment? That means we have disrupted the entire nation because we have relied on one supplier.

Then ICT Minister, Supa Mandiwanzira

It was a valid point. As the months rolled by, the government’s attitude towards EcoCash continued to sour.

We almost have a monopoly so they think they can do whatever they want

Then ICT Minister Supa Mandiwanzira

When a sitting minister is saying that about your company, just know you are in for a bumpy ride. EcoCash was in the cross hairs then.

2019-present: EcoCash stagnates

It was almost poetic that the cash crisis which led to EcoCash dominance was the same that turned around to bite them where it hurts.

By the end of 2018, their agents were abusing the system and charging a premium to users cashing out their money.

The agents were responding to the prevailing economic conditions caused by the government’s monetary policies. However, it was EcoCash which suffered the tarnished reputation.

Perfect storm

When it rains, it pours. For EcoCash it poured cats, dogs and cows after 2019.

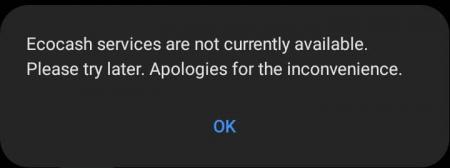

Perhaps the rapid growth had been a tad bit too rapid because they started experiencing technical difficulties just a little too frequently. This was unacceptable for a service many relied on. Turns out the ICT minister had been right.

With rogue agents ‘selling cash’ and system stability compromised, the perfect storm had brewed for EcoCash and the regulators swooped in to deal with the situation.

Cashing in and out was banned, one of their core services. The premium for cash on the black market soared.

Cash-in and out transactions were reinstated but at a lower maximum amount. That was a win for EcoCash. Truth is, they don’t like cash outs because that’s money leaving the EcoCash platform. So, the limited maximums helped lock funds in EcoCash.

2020 came, Covid rocked the nation and the EcoCash story continued its windings:

• Government decides to distribute Covid relief funds exclusively through OneMoney. EcoCash scraps all charges for such distributions to lure in those funds.

• Mobile money agents (mostly EcoCash) have their accounts frozen under suspicion they were involved in illicit forex deals.

• EcoCash realizes the damage this could do and takes the regulators to court over the frozen accounts. All the while exaggerating the impact of the freeze.

• At this point the RBZ and EcoCash have battle lines drawn.

• The regulators throw big punches, charging EcoCash and Cassava CEOs with money laundering.

• The government through, the Information ministry announces that all mobile money transactions are banned.

• EcoCash responds that it is regulated by the RBZ and so continues operations.

• The government recants, says ban applies to agents and merchants only.

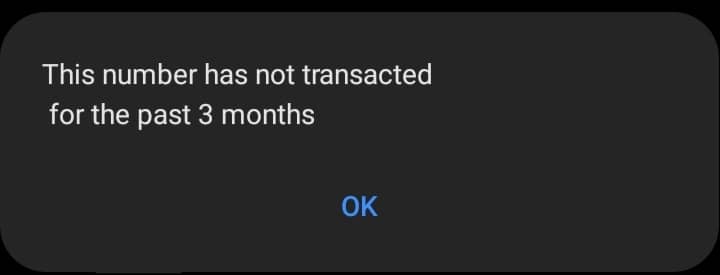

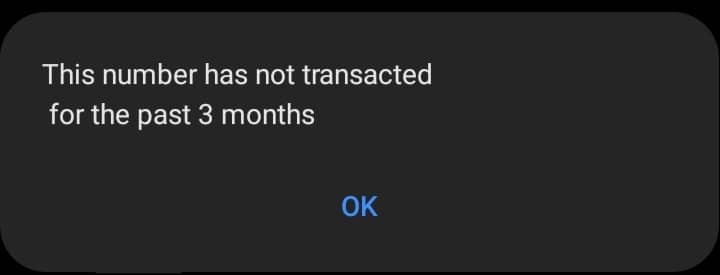

Although the public could still transact, this wasn’t a win for EcoCash for two main reasons:

1. Merchants started refusing EcoCash transfers. Since they could no longer move funds in EcoCash freely, they started accepting everything but EcoCash.

2. The ban diminished EcoCash’s utility to the transacting public. The usecases for EcoCash dwindled because of the merchants’ actions.

EcoCash was truly in a pickle then.

• No cash in cash out transactions meant the only way for money to enter the EcoCash platform was from a bank account. All of a sudden, they needed people to have bank accounts and so they promoted the banks they are integrated with.

• Problem was, let’s say a user heeded the call and opened a bank account. Why would he then transfer the money into EcoCash when more and more merchants were refusing that payment method but accepting bank card payments?

The government wasn’t done. EcoCash was forced to integrate with Zimswitch, it’s biggest competitor. The move was meant to reduce any barriers to leaving EcoCash that remained and to neutralize the power of its agent and merchant network.

There are other significant entries in this journal but that is where EcoCash is today. Still very much on the government’s radar.

This regulatory pressure has severely impacted EcoCash. They detailed the government actions that had hampered their progress as:

21st April 2020 – Reduction in daily, monthly and transactional limits,

4th May 2020 – Suspension of Agents with transactions above ZW$100,000 and requirement for their re-registration,

4th June 2020 – Suspension of Agent to Agent transactions,

26th June 2020 – Directive to integrate to Zimswitch, in line with SI 80, by 30 September 2020,

27th June 2020 – Suspension of some Ecocash User Categories and Functions,

25th August 2020 – Revision of mobile money limits and permissible transactions,

25th August 2020 – Ban of use of multiple wallets by individuals effective 8 September 2020.

Conclusion

Not much has changed since then. And so ten years in, the star does not shine as bright as it should have been shining.

Although they had to deal with an erratic and often irrational and vengeful government, EcoCash has mostly itself to blame for it’s clipped wings.

That being said, the service is by no means done for. It has been a topsy-turvy decade but all things considered, EcoCash has been wildly successful.

Looking forward to see what the next 10 years will look like.

Quick NetOne, Econet, And Telecel Airtime Recharge

The post EcoCash turns 10, let us look back on its dramatic first decade appeared first on Techzim.