Lamudi issues release on expansion into Zimbabwe but says very little

Why, really, is ZESA not selling prepaid electricity tokens on EcoCash and Telecash?

Nettcash Mobile Money Services is launched with an innovative set of features

EcoCash Hack: Here’s how you can pay less transaction fees

A list of Econet’s gripes with Zimbabwe’s telecoms business ecosystem

Use this Android app to pay less in EcoCash & Telecash mobile money tariffs

Zipcash money transfer service expanding into West Africa

Telecash agents and merchants total increases to over 3000

Zimpost needs to embrace tech to stay relevant

Tel One phone bills payable through Telecash bill option

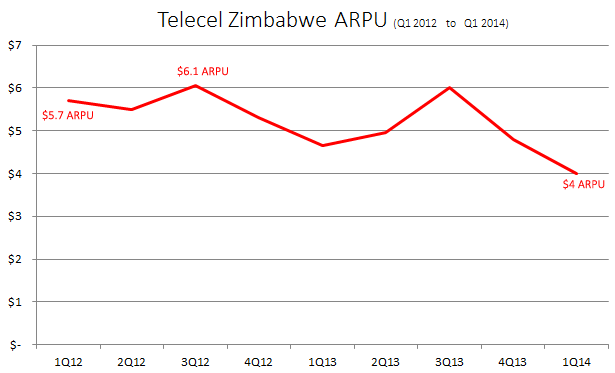

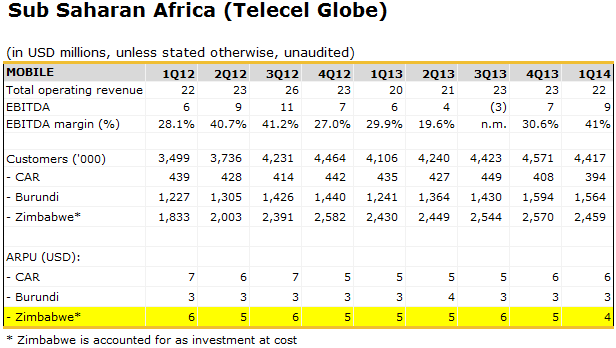

Telecel Zimbabwe’s Average Revenue Per User at lowest point since 2012 (graph)

Telecel Zimbabwe’s Average Revenue Per User (ARPU) reached the lowest of $4 in the first quarter of 2014. The information was part of the quarterly financials released by the its parent company in Vimpelcom.

Telecel Zimbabwe’s Average Revenue Per User (ARPU) reached the lowest of $4 in the first quarter of 2014. The information was part of the quarterly financials released by the its parent company in Vimpelcom.

Before now Telecel’s highest ARPU was in the third quarter of 2012 when it $6.1 ARPU performance. The current low ARPU is not really a surprise, and indeed it’s not just Telecel experiencing these problems. The company is operating in an industry where traditional revenue streams like voice are dwindling while data uptake hasn’t made up for that revenue. Add to that the current liquidity challenges in the country and you have a unpleasant space for an operator to be.

What would have been more useful is if this could be compared to the other two mobile operators in ZImbabwe. Unfortunately, both Econet and NetOne have not made their ARPU figures available.

The average revenue per user is generally a revenue growth indicator as a result of promotions and supplemental services provided by a company. It is also used to measure how profitability potential of the operator.

Though late to the game in the market, this year Telecel launched its mobile money service, Telecash. It’s not clear yet how activity on that front will affect revenue for the company in the future, but what’s clear is that it will not be in the short term.

Here’s the data and graph of Telecel’s ARPU since first quarter of 2012:

A comparison Zimbabwean mobile money tariffs

The local mobile money transfer market has been going through a number of changes with three players joining the fray in the past year. With such a field the most common area of competitive differentiation is pricing.

The local mobile money transfer market has been going through a number of changes with three players joining the fray in the past year. With such a field the most common area of competitive differentiation is pricing.

We have put together the list of mobile money transfer rates for the mobile payment services offered by the operators namely Ecocash, Telecash, OneWallet, and Nettcash.

A quick comparison shows how Netone’s OneWallet has the lowest tariffs. This advantage does however come with the drawback of a limited agent and merchant network which Netone seems to have tried to make up for by offering exclusive mobile money services such as the ZESA prepaid electricity payment option.

Nettcash, the latest entrant in mobile money has the highest tariffs here, although their network neutrality is the biggest advantage that might be considered as the greatest consolation for its users.

With these tariffs likely to be revised as these service providers’ market share changes competitive advantage is likely to be determined by service variety, bill payment options and convenience.

Below are three tables illustrating the different operators and their tariffs

Tariffs for sending to a user registered for the respective service

AMOUNTS | SEND TO REGISTERED | |||

|---|---|---|---|---|

| $USD | ECOCASH | TELECASH | NETTCASH | ONEWALLET |

| 1.00 - 1.99 | 0.14 | 0.07 | 0.04 | |

| 2.00 - 5 | 0.14 | 0.13 | 0.15 | |

| 5.01 - 10 | 0.24 | 0.20 | 0.25 | 1.5% of transaction value |

| 10.01 - 20 | 0.44 | 0.34 | 0.50 | 1.5% of transaction value |

| 20.01 - 30 | 0.64 | 0.54 | 0.74 | 1.5% of transaction value |

| 30.01 - 40 | 0.84 | 0.74 | 1.00 | 1.5% of transaction value |

| 40.00 - 50 | 1.84 | 0.94 | 1.24 | 1.5% of transaction value |

| 50.01 - 75 | 1.54 | 1.24 | 1.80 | 1.5% of transaction value |

| 75.01 - 100 | 2.00 | 1.55 | 2.45 | 1.5% of transaction value |

| 100.01 - 150 | 2.50 | 2.05 | 2.70 | 1.5% of transaction value |

| 150.01 - 200 | 3.00 | 2.55 | 3.40 | 1.5% of transaction value |

| 200.01 - 300 | 4.05 | 3.55 | 4.35 | 1.3% of transaction value |

| 300.01 - 400 | 4.35 | 3.95 | 4.75 | 1.0% of transaction value |

| 400.01 - 500 | 4.54 | 4.04 | 4.80 | 0.9% of transaction value |

Tariffs for sending to a recipient not registered for the same service

AMOUNTS | SEND TO UNREGISTERED | |||

|---|---|---|---|---|

| $USD | ECOCASH | TELECASH | NETTCASH | ONEWALLET |

| 1.00 - 1.99 | 0.07 | 0.12 | ||

| 2.00 - 5 | 0.54 | 0.35 | 0.30 | |

| 5.01 - 10 | 0.74 | 0.55 | 0.60 | 3% of transaction value |

| 10.01 - 20 | 1.34 | 0.95 | 1.20 | 3% of transaction value |

| 20.01 - 30 | 1.84 | 1.35 | 1.80 | 3% of transaction value |

| 30.01 - 40 | 2.34 | 1.85 | 2.40 | 3% of transaction value |

| 40.00 - 50 | 3.54 | 2.55 | 3.00 | 3% of transaction value |

| 50.01 - 75 | 5.04 | 3.95 | 4.80 | 3% of transaction value |

| 75.01 - 100 | 7.00 | 6.05 | 6.00 | 3% of transaction value |

| 100.01 - 150 | 8.50 | 6.55 | 9.00 | 3% of transaction value |

| 150.01 - 200 | 9.60 | 7.55 | 12.00 | 3% of transaction value |

| 200.01 - 300 | 11.00 | 8.65 | 17.00 CAP | 2.8% of transaction value |

| 300.01 - 400 | 13.05 | 9.55 | 17.00 CAP | 2.2% of transaction value |

| 400.01 - 500 | 14.04 | 9.85 | 17.00 CAP | 2% of transaction value |

Cash-out tariffs for registered user

AMOUNTS | CASH OUT REGISTERED | |||

|---|---|---|---|---|

| $USD | ECOCASH | TELECASH | NETTCASH | ONEWALLET |

| 1.00 - 1.99 | 0.08 | 0.04 | ||

| 2.00 - 5 | 0.20 | 0.15 | 0.15 | |

| 5.01 - 10 | 0.30 | 0.25 | 0.25 | 1.5% of transaction value |

| 10.01 - 20 | 0.60 | 0.50 | 0.50 | 1.5% of transaction value |

| 20.01 - 30 | 0.90 | 0.75 | 0.74 | 1.5% of transaction value |

| 30.01 - 40 | 1.20 | 0.95 | 1.00 | 1.5% of transaction value |

| 40.00 - 50 | 1.50 | 1.25 | 1.24 | 1.5% of transaction value |

| 50.01 - 75 | 2.30 | 2.05 | 1.80 | 1.5% of transaction value |

| 75.01 - 100 | 3.05 | 2.55 | 2.45 | 1.5% of transaction value |

| 100.01 - 150 | 3.50 | 2.95 | 2.70 | 1.5% of transaction value |

| 150.01 - 200 | 3.90 | 3.45 | 3.40 | 1.5% of transaction value |

| 200.01 - 300 | 4.85 | 4.04 | 4.35 | 1.5% of transaction value |

| 300.01 - 400 | 4.90 | 4.45 | 4.75 | 1.2% of transaction value |

| 400.01 - 500 | 4.95 | 4.55 | 4.80 | 1.1% of transaction value |

Econet partners WorldRemit to enable diaspora remittances to EcoCash wallets

EcoCash CEO, Cuthbert tembedza, speaks at the launch of the new remittance service. On his right is Econet Wireless Services CEO, Darlington Mandivenga, and on his left WorldRemit Director, Rob Ayers and Econet Sales & Marketing Director Isaiah Nyangare

Econet Wireless Services and WorldRemit today launched a new international remittance service to enable anyone around the world to transfer money to an EcoCash wallet in Zimbabwe. Using the service, anyone in the 35 markets that WorldRemit operates from (including US, UK, South Africa, Australia, Canada) will be able to transfer money directly into and EcoCash wallet. The transfers will be made using credit or debit cards via the WorldRemit website here: worldremit.com.

The announcement of the new service was made today at a function in Harare where executives from both EcoCash and WorldRemit spoke. EcoCash via WorldRemit is not exactly new. We started noticing the EcoCash logo on the WorldRemit website at least a couple of months ago. Today just shows the two companies are now ready to start talking about it.

As with other remittance products in the Zimbabwean market, transfers will only be inbound into Zimbabwe and not outbound. A regulatory restriction from back in the Hyperinflation days.

WorldRemit already has a similar partnership with mobile operators in Kenya, Ghana, Ethiopia and other parts of Africa.

Speed, convenience & the competition

The two companies are banking on the convenience & speed of the service in comparison with existing competition; the sender is not limited by time as they can send money any time of the day or night from the WorldRemit website and have it delivered instantly to an EcoCash mobile phone wallet in Zimbabwe. Zimbabwe is not fully 24 hours yet though because if the recipient receives the money at night, they’ll have to pray an agent is open, or wait for the next day. Still this slight inconvenience is nothing compared to existing options; EcoCash has about 13,000 agents right now.

Talking about existing competition EcoCash CEO Cuthbert Tembedza said at the event that the bulk of money coming into Zimbabwe is via informal means and therefore they don’t consider other money transfer companies as competition but as potential partners. WorldRemit, explained Tembedza, is only one of the first partners they are signing on but will be signing on more partners in the coming months. Maybe Mukuru.com will be the next partner to be announced, who knows?

Talking about existing competition EcoCash CEO Cuthbert Tembedza said at the event that the bulk of money coming into Zimbabwe is via informal means and therefore they don’t consider other money transfer companies as competition but as potential partners. WorldRemit, explained Tembedza, is only one of the first partners they are signing on but will be signing on more partners in the coming months. Maybe Mukuru.com will be the next partner to be announced, who knows?

Lower Transfer Fees than existing options

They are also banking on the lower cost of transferring money. WorldRemit will charge around 5% (it’s different for every source country) for transfers while EcoCash will not charge the recipient any additional fees for the transaction. Western Union charges around 10%.

What about what they launched in South Africa last year

If you have been following Econet’s international remittances developments then you will realise that they last year they launched something for the South Africa – Zimbabwe corridor, and you are probably wondering if the two are linked. We asked Econet and the EcoCash CEO said they were the same thing and that they are always working on a lot of things internally. We’re not sure what exactly that means but we’re starting to suspect that the South Africa thing didn’t go too well. if it had, today would have been an announcement of further corridors being launched.

That said, we’re happy about this product. I don’t know a single person who doesn’t have a relative in the US, UK, South Africa, Canada or Australia. For those people this is great news. no more queuing at the Western Union or Moneygram counter at the bank. Both for the sender and recipient. This is a big deal.

Here are some more pictures from the announcement:

Textacash shows growth in a competitive mobile money space

Mobile money has redefined financial services locally and every serious service provider in the industry has tried to get in on the action.

Mobile money has redefined financial services locally and every serious service provider in the industry has tried to get in on the action.

Local banks were relatively late adopters of m-commerce but despite this some of these institutions have managed to make remarkable progress even in the face of steam rolling competition from the likes EcoCash and other MNOs with their huge subscriber bases.

Textacash, launched by local building society CABS, is a mobile money solution for the bank’s extensive client base and for other potential customers keen on experiencing the advantages of mobile money integrated with ZIMSWITCH services.

We managed to get information from CABS officials on how Textacash has been faring in the past year and since the last time we took a close look at the service it has shown some growth. This is commendable considering the challenges being felt in the banking sector which have had an effect on services like mobile money.

As of the end of April 2014 the Textacash subscribers total stood at 306, 000. Quite impressive considering that in the first quarter of 2013 CABS had 200, 000 traditional banking clients and another 75,000 exclusive to the Textacash service.

Textacash has approximately 500 registered agents added to CABS network of 67 branches nationwide. While this pales in comparison to the agents and merchant figures being brandished by Telecash and EcoCash its worth noting that these figures signify what is probably the largest network from any other financial institution involved in mobile money.

The agents network has contributed handsomely to CABS’ revenue. In the last financial period non-interest income for the building society increased by 13% due to an (undisclosed) increase in transactions made through delivery channels like Textacash.

The issue of agents is always a big deal for any mobile money service. While Textacash has had the advantage of rolling out through an existing retail bank network and smartly through retail outlets that are on ZIMSWITCH, this area will always act as the biggest factor for market penetration and growth.

The Textacash pool account also made a 30% growth in deposits, indicating Textacash’s role in diverting funds from an unbanked, informal economy into the formal banking system.

Like every other mobile money service Textacash has had to levy the state designated 5c tax on every transaction which has meant a minor adjustment to their tariff schedule to accommodate this.

According to CABS, new product development is in place to strengthen the Textacash offering and accommodate customer needs. It will be interesting to see what sort of value will be unlocked by the financial institution and their mobile money service and whether it will be able to maintain growth and a positive trajectory in this space.

e-ticketing for PSL games a welcome development not just for soccer

An article carried in the Newsday has detailed how the local football’s Castle Lager Premier Soccer League is set to try out an e-ticketing system for league matches played starting with Harare and Zvishavane this weekend.

Two companies that were identified from a tender flighted for the system will be engaged in the trial run and PSL will work with two companies for each consecutive trial run until the final selection. The e-ticketing will be done outside the stadium. This part however doesn’t seem to make sense considering that an e-ticket is supposed to get me the ticket before I get to the event.

With a total of twenty companies submitting tenders this is an idea that seems to have toyed with by a number of local providers. The challenge seems to be with relevant service providers identifying the opportunity, something that PSL has had the good sense to do. In March this year an idea for e-ticketing system was pitched by Pascal Nyasha at the Emerging Ideas Pitch Night.

An e-ticketing system enables online booking, ordering and buying of tickets which can be printed at home or like in the case of similar services like Computicket the tickets can be obtained from a participating outlet. The system uses a barcode on each ticket for authentication. The ticket can be also be accessed via mobile devices through QR technology

We spoke to the CEO of PSL Zimbabwe, Kennedy Ndebele, who explained how the PSL has been working on the introduction of the digital solution since the beginning of the year. Ndebele said that all the teams in the league are in support of the e-ticketing option which would reduce corrupt tendencies surrounding gate takings as well as the queuing and commotion at the gates.

While the trial run will have a simple cash payment model Ndebele could not confirm whether or not the system they want to introduce will integrate a mobile money payment option. These specifics will be ironed out with the company that wins the tender. For a country that relies heavily on mobile money payments as the main gateway to e-commerce this consideration should of course be one of the main priorities.

According to Ndebele this system will only be for PSL games which means that National team fixtures hosted by ZIFA will still be restricted to the manual option. Hopefully the use of e-ticketing will be taken up by the local football governing body and other service providers. It simplifies ticket reservation for everything from plane tickets, movies, theatre, tourist destinations like game reserves concerts and festivals (think HIFA).

The biggest take away from an electronic system is definitely the way it narrows the room for corrupt practice, something which should make ZIMRA lobby for a wider introduction of such a service. But if you are just tired of jostling in a queue at the stadium this is a welcome development.

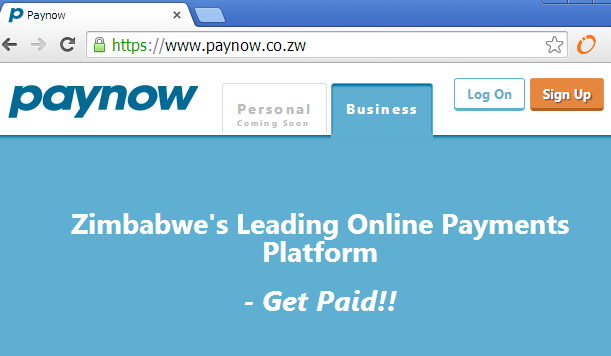

Paynow, a new Zimbabwean internet payments gateway. Simplicity at its best

If you tried to buy a ticket to the Broadband Forum event that we held last week, you probably noticed you could buy online, and that we were accepting EcoCash, ZimSwitch Vpayments and even VISA. And it worked seamlessly both for us and the people paying. We were using the new internet payments platform by Webdev called Paynow. The platform has been live for a couple of weeks now.

If you tried to buy a ticket to the Broadband Forum event that we held last week, you probably noticed you could buy online, and that we were accepting EcoCash, ZimSwitch Vpayments and even VISA. And it worked seamlessly both for us and the people paying. We were using the new internet payments platform by Webdev called Paynow. The platform has been live for a couple of weeks now.

Like all other services on the market – ZimSwitch’s Vpayments, Pay4App, PesaPal, FloCash - at the core, Paynow enables anyone with a website or app to start receiving payments online from major credit cards as well as, for some at least, local bank cards and local mobile money wallets.

So yes, Paynow comes to a market where a number of solutions have been launched already but introduces one key thing that has been seriously lacking. Simplicity. From the point of signing up for a merchant account, setting it up on a website, and getting your money into your bank account, everything is simple and straightforward.

We also liked that there’s now waiting. You sign up for a merchant account by providing your bank details and you’re ready to start receiving payments. The bank itself is not involved at all in the signup process. Paynow also allows you to receive payments direct to your bank account as people pay. It doesn’t matter if payment was made via EcoCash, Visa or ZimSwitch Vpayments, the money comes to your one bank account. And it comes with no threshold conditions to be met.

We loved how Paynow performed for the Broadband Forum. It simplified payments a lot for us so it takes the prize as one of the most promising payments startups to come out of Zimbabwe. Hell, Africa!

Commenting on the discussion at an eCommerce tech meetup yesterday by TechLair, a friend said:

@lskmakani @thetechlairzw to be honest companies are too busy trying to reinvent the wheel because of no PayPal Etc…

— Anthony Somerset (@anthonysomerset) June 12, 2014

It may be a while before our government and the US (government and companies) are happy to work with each other, and we’ll let the politicians do the politics. In the meantime, it’s great that PayPal’s absence is forcing the birth of a crop of startups that will be relevant to solve local problems and may even be relevant globally.

EcoCash Diaspora: Here are the countries you can remit money from

As you may know, two days ago Econet and WorldRemit announced the launch of a service that allows people outside Zimbabwe to remit money into Zimbabwe directly into EcoCash mobile money wallets. When we wrote the article initially we said, incorrectly it turns out, that people can use the WorldRemit service to send money from South Africa.

As you may know, two days ago Econet and WorldRemit announced the launch of a service that allows people outside Zimbabwe to remit money into Zimbabwe directly into EcoCash mobile money wallets. When we wrote the article initially we said, incorrectly it turns out, that people can use the WorldRemit service to send money from South Africa.

South Africa and the US are on the list of 35 countries on the WorldRemit website. A number of people commented and tweeted that the service actually wasn’t available for SA.

We asked WorldRemit Director, Rob Ayers, and he confirmed that South Africa isn’t actually enabled for outbound transfers yet:

The Central Bank of S. Africa keeps tight controls on funds leaving the country and makes it difficult to obtain a license. We are working on an approval, but it is difficult to give a timeframe at this point.

list. The correct list has 27 countries which includes the UK, Australia, Canada. No US and no SA. The list is on the right and on the Econet website.

And you can view the EcoCash Diaspora Press release here.

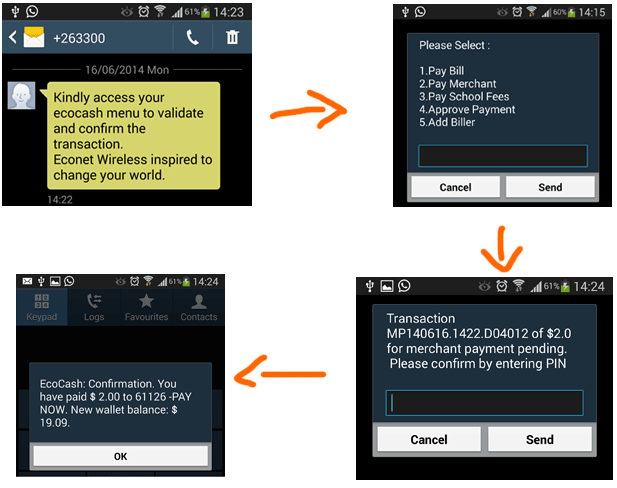

The EcoCash official mobile money API is live. But only for some developers

The issue of the EcoCash API has been elusive. First it was a rumour last year. EcoCash itself denied it officially, but those inside told us the company was indeed working on something, or at least had got some people to work on something to enable merchants to process payments online. Then came what appeared to be Econet’s own EcoCash payment gateway, which, soon after our report, was taken down. Without any official info, all we could do was speculate. The speculation has ended though. The EcoCash API is live.

The issue of the EcoCash API has been elusive. First it was a rumour last year. EcoCash itself denied it officially, but those inside told us the company was indeed working on something, or at least had got some people to work on something to enable merchants to process payments online. Then came what appeared to be Econet’s own EcoCash payment gateway, which, soon after our report, was taken down. Without any official info, all we could do was speculate. The speculation has ended though. The EcoCash API is live.

If you read last week’s article on the Paynow payment gateway, you probably suspected so already. if you have also been paying attention to the menu options on your EcoCash USSD, you’d also have noticed something new. Under the “Make Payment” there’s a new “Approve Payment” option. This is how a typical payment goes. You supply your EcoCash mobile number online to Paynow. Paynow connects to EcoCash via the API, and sends the message that you just requested to pay a certain amount. EcoCash sends you an SMS, and….

Until now, anyone developing an app, web or mobile, that used EcoCash, would have to implement a workaround where the actual payment would be done manually. That’s how we’ve been using EcoCash on our Store and other payment needs here at Techzim.

But that has changed and two third party apps are there to show it: First Paynow as just demonstrated, but also WorldRemit who can now push money into an EcoCash EcoCash Wallet from outside EcoCash walls.

Information we have is that Econet has been testing the API with some selected developers for a couple of months at least. We even had an API document shared with us early this year. It’s not clear yet if Econet will make the API publicly available, or its going to be the same Value Added Service shortcode restrictions that the local ecosystem has had to endure even to this day.

We also have no idea how many other development companies have access to this API so far, and the fact that Econet is not yet speaking about it probably means very few.

PayPal now available in Zimbabwe. But not for merchants and peer to peer

This, it turns out, is a payments week! It’s official, PayPal is coming to Zimbabwe starting tomorrow, 17 June 2014.

This, it turns out, is a payments week! It’s official, PayPal is coming to Zimbabwe starting tomorrow, 17 June 2014.

The announcement was made today by Rupert Keeley, the executive in charge PayPal’s Europe Middle East and Africa region, in an interview he gave to Reuters.

PayPal will be opening up its services to Zimbabwe and some 9 other countries in Africa and Europe and South America. Notable of those is Nigeria which, even though it has Africa’s highest internet population at above 60 million. The other countries are Cameroon, Ivory Coast, Belarus, Paraguay, Macedonia, Moldova, Monaco and Montenegro.

On why it’s happening now Keeley said: “PayPal has been going through a period of reinvention, refreshing many of its services to make them easier to use on mobile (phones), allowing us to expand into fast-developing markets,”

Part of the realisation ofcourse is that these markets won’t wait for PayPal to come, but will instead go to more flexible competition. And in the case of Zimbabwe, startups have emerged to fill the need for payments online. Like Paynow and Pay4App. Paynow was introduced to the market several weeks ago, and we first reported on it last week.

Unfortunately, not the whole PayPal

It’s not the full PayPal that’s being opened up in these 10 countries. According to Reuters PayPal is only offering “send money” services which means the peopl in these markets will now be able to create accounts using their local addresses and after that pay for services.

The most useful services in terms of building an ecosystem, Peer to peer payments and local merchant accounts, will not be enabled yet. This will clearly not amuse financial authorities in these countries as it basically means PayPal is enabling money to be paid out, but none to be paid in, or at least to be paid within a country. Zimbabwe already has regulations restricting outbound payments, especially those going through remittance companies like Moneygram and Western Union. they have been more relaxed on payments via the web though with Mastercard and Visa payments happening generally unfettered.

It’s not the first time PayPal has relaxed restrictions on markets it deems bad. it used to be that even if you had an account from say America, just the act of accessing your PayPal from Zimbabwe would have you blocked from the service. It was virtually impossible to use PayPal from Zimbabwe unless you were hiding behind a proxy or VSAT connection. In 2012, PayPal relaxed that a bit to allow the use of the service from Zimbabwe. They however still wouldn’t let you sign up for an account from Zimbabwe, or use a Zimbabwean address, essentially only service the needs of expats and visitors.

The recent development is good. Not enough, but better than the madness that’s prevailed thus far. Merchants just need to find a work around the problem of not basing the merchant account in Zimbabwe!

PayPal is not likely to threaten local payment providers like Pay4App and Paynow. The local ones have access to and provide local mobile money payment options like EcoCash and Telecash. Without the full stack of payments, PayPal also comes with very little to be of any current use startups or retailers looking into eCommerce.

Thank you: Ad Mire Makusha

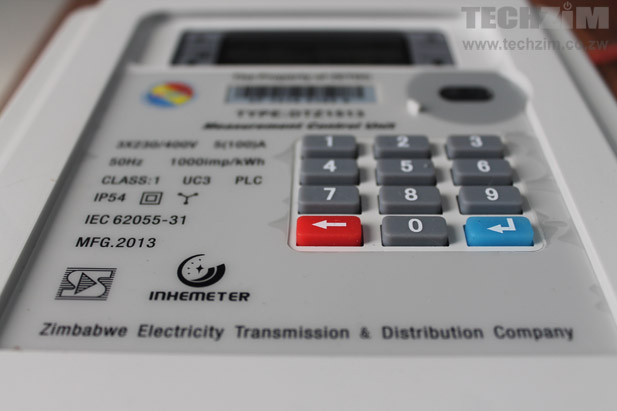

ZESA adds TelOne, Agribank to electricity coupon agents. Excludes Econet, Telecel

The mobile payments revolution of the past three years has brought unparalleled convenience to Zimbabwe. Just as it has in many African countries. It has meant significantly less hassle in moving money (and therefore value) between people and between people and business. Everything from paying your water bill, pay TV subscription, insurance and even school fees.

The mobile payments revolution of the past three years has brought unparalleled convenience to Zimbabwe. Just as it has in many African countries. It has meant significantly less hassle in moving money (and therefore value) between people and between people and business. Everything from paying your water bill, pay TV subscription, insurance and even school fees.

ZESA, however, chooses to refuse its customers this convenience. In press ads this week, the national power company announced that it had added 2 more companies to retail electronic electricity coupons. The companies; TelOne, the country’s sole fixed line operator, Agribank, a government owned bank established to help Zimbabwe’s farmers access friendly financing. Both have no mobile phone product so it really means going to their branches. But even if they did, their numbers are dwarfed by the millions the mobile operators have managed to achieve with mobile money.

Granted, NetOne (a government owned mobile operator) also sells the electricity coupons, but NetOne’s numbers too are too small when compared to the elephant in the room. EcoCash. ZESA has to stop this blatant madness. The blocking of private companies like Econet, Telecel, CABS and others from accessing the service means they are deliberately choosing to make the service inconvenient to use.

Being a monopoly, it’s understandable how they don’t feel threatened by this stance. But if they don’t care about their own customers at least they should care that making it harder to pay directly hits not just their bottom line, but the country’s as well.